As one year transitions into another, we always see a sudden rush to get or start getting your financial house in order. A lot of bulleted or numbered lists come out of things to do without necessarily explaining why you need to do it. Maybe the assumption is that you already know which begs the question if you did know, wouldn’t your finances already be in order?

The reality is that many people who live in the US are not financially literate or put another way they don’t fully understand the language of money. That lack of understanding is what leads to having a financial mess on your hands. Let’s be clear though – IT’S NOT THEIR FAULT!

Nowhere in the education system of this country is financial literacy CONSISTENTLY taught. As a former public school educator that had a previous career in finance Ms. ME found it particularly amusing that sometimes the courses that were offered were taught by individuals who lacked financial know-how themselves. This glaring absence of competent & consistent education leads to almost half of the population not knowing things that are key to keeping your bank accounts and overall finances in the black.

Think we’re kidding? Take the quiz on the website above and then post your score in the comments below if you’re brave. Are you financially literate?

If you get a score that you feel is too low to post, here’s how you change it. Register for this free course happening January 4th at 8 PM EST and increase your financial literacy in record time!

Well regardless of what score you get we’re going to give you our bulleted list and the reasons for each. But at the end of the day it’s on you to take the actions we suggest or risk another year in the same financial state or a worse one.

4 Steps to Financial Wellness

1 – Know your current situation

Does your doctor diagnose you without first giving you an examination? Of course not! The same goes for the financial pro you work with; they can’t give you a prescription for financial wellness without knowing where you are right now. To do that, YOU have to take an honest look at where you are right now. How much do you earn in a month? How much does it cost for you (and your family) to exist from month to month? Where is your money currently going? Knowing those things are key to either taking the next steps yourself or working with your financial pro on the next steps.

2 – Eliminate the unnecessary

This one is often difficult because here in the US advertising has convinced so many that they need everything they see to be happy. You really have to step back and determine what actually is a need versus a want. Does that mean you can’t have any wants? ABSOLUTELY NOT!! But sometimes you end up wanting something to, as that old saying goes, keep up with the Joneses instead of satisfying some intrinsic desire. Buying things to impress people you don’t like or who don’t contribute positively to your life should not be something you continue to do. So cut it out!

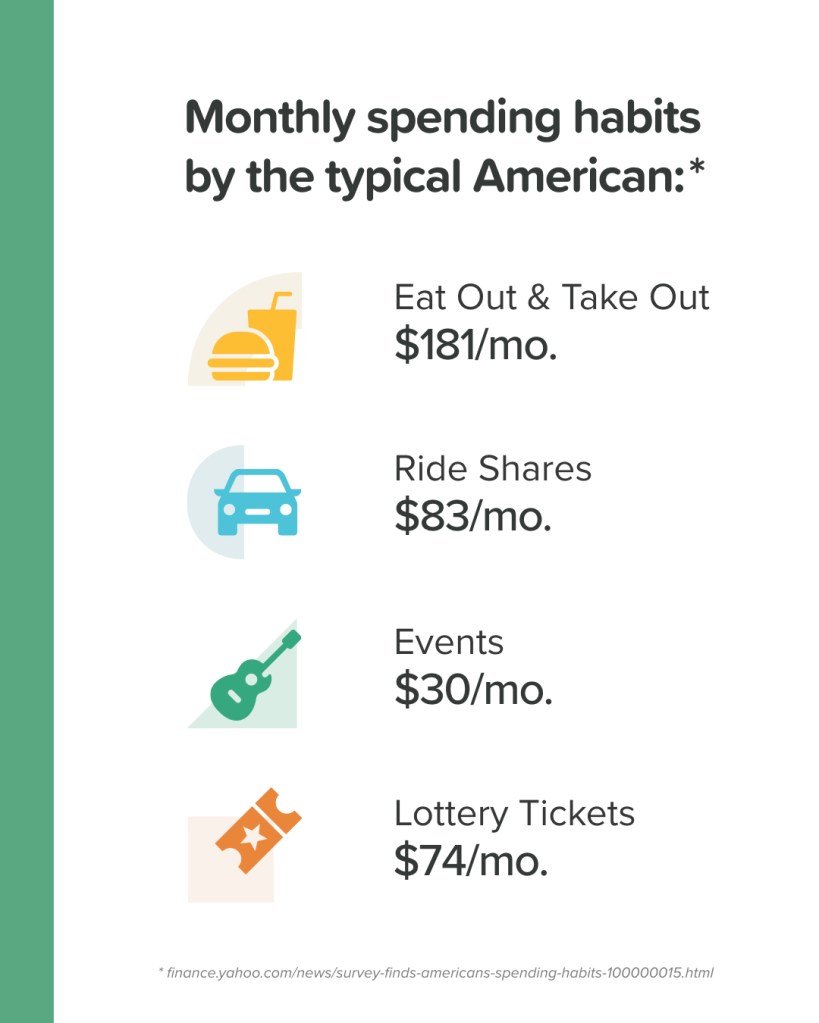

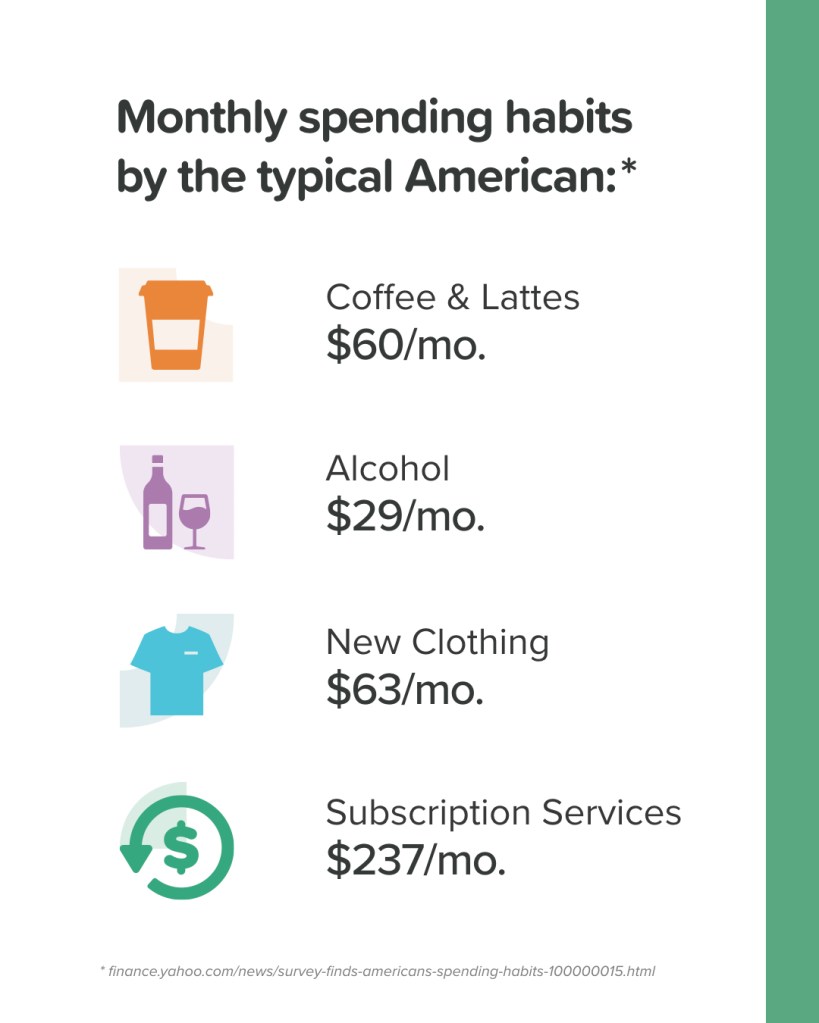

Then start looking at other ways you might be spending more than you have to like on overpriced bill that you haven’t price-shopped in a while like internet or insurance. Or perhaps you have some of the habits below that you’d like to adjust or eliminate entirely.

3 – Set some goals

We all want things but often don’t think about those wants any further out than one to three years. That short-term thinking does not add up to financial wellness. It’s great to have short-term goals but make sure they are realistic. If you have no savings, buying a home is more of a mid or long term goal, not a short-term one. So after completing the first two steps, write out what you want and then put some timeframes beside them. Here’s a guide to help group those wants:

4 – Make a plan

The last step is to make a plan to reach those goals. Making the plan ranges in complexity based on how many goals you have. But the even harder part for many is following the plan. If you need help with this or any of the previous steps, don’t forget to come to the FREE live class on January 4, 2024 at 8 PM ET. We’ll be sharing a free tool to help with one or more of the steps and introducing our community to find help when you need it.